Shared budgets

Stay aligned with someone else. Share a budget and keep it in sync.

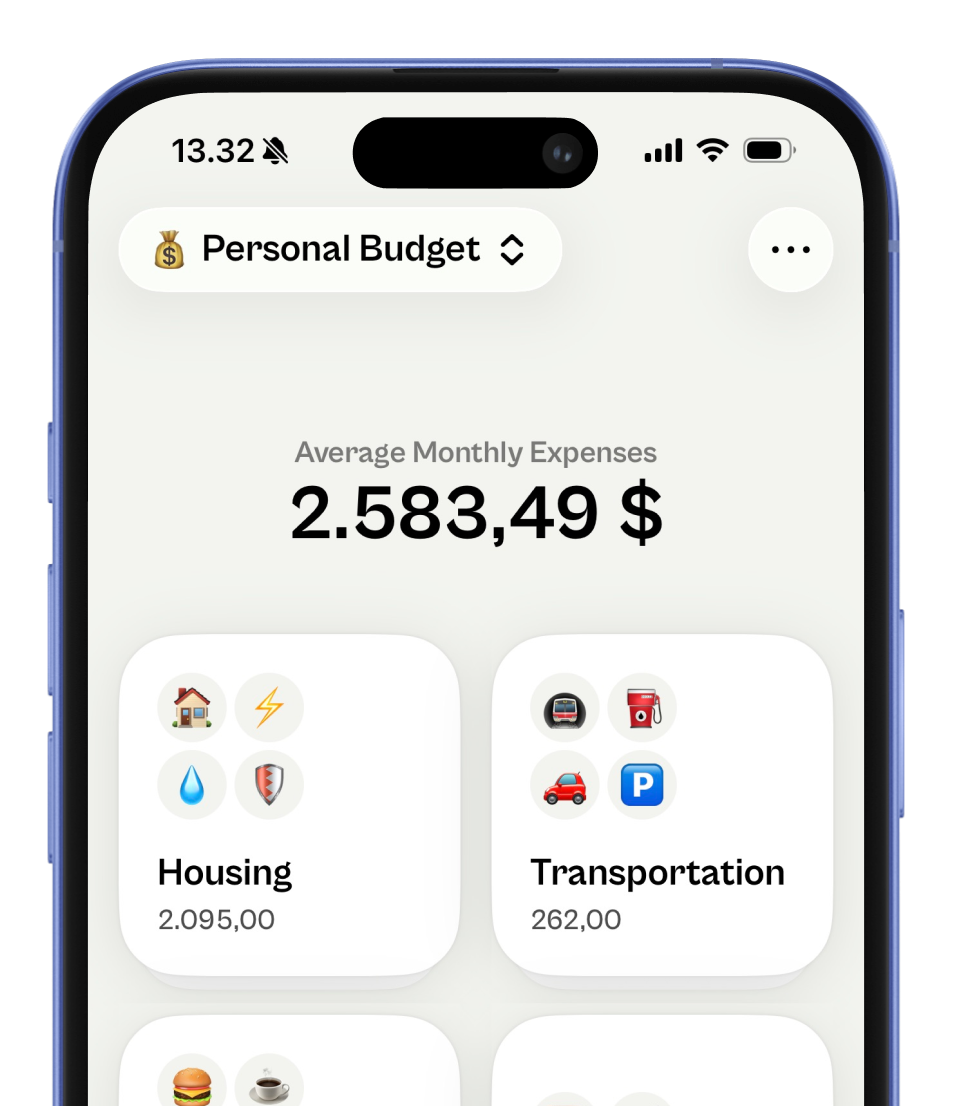

Turn upcoming bills and income into a clear monthly overview, without constant tracking or spreadsheets

Stay aligned with someone else. Share a budget and keep it in sync.

Never get surprised by what's due. Plan recurring expenses and income.

Keep parts of life separate. Create budgets for personal, business, or side gig.

Skip the conversion hassle. Add bills in other currencies and see totals in your home currency.

Avoid wrong account moments. Assign bills to the account they'll be paid from.

Keep big plans moving. Use trackers for savings, debt, and bigger purchases.

See where your plan leads. Project debt payoff or savings growth.

Know your month works. See income vs planned expenses.

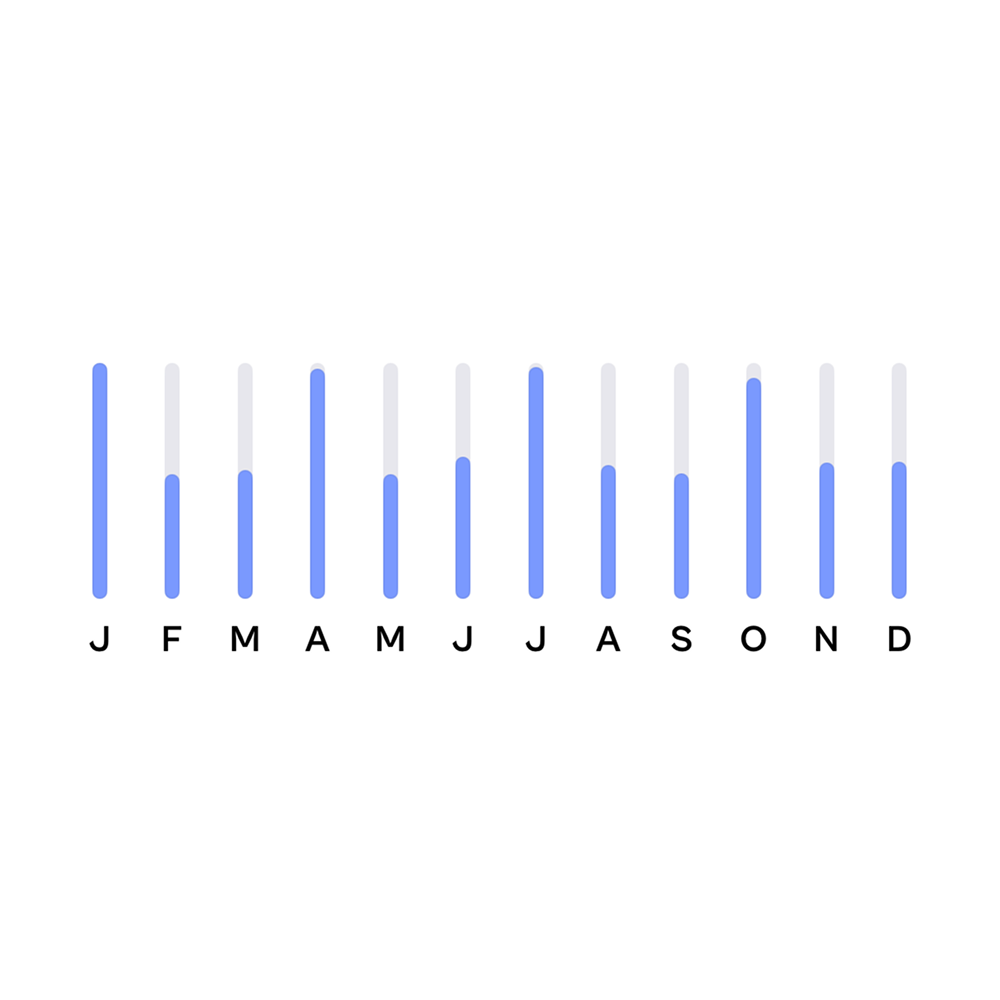

See heavy months coming. Compare months to spot higher cost periods early.

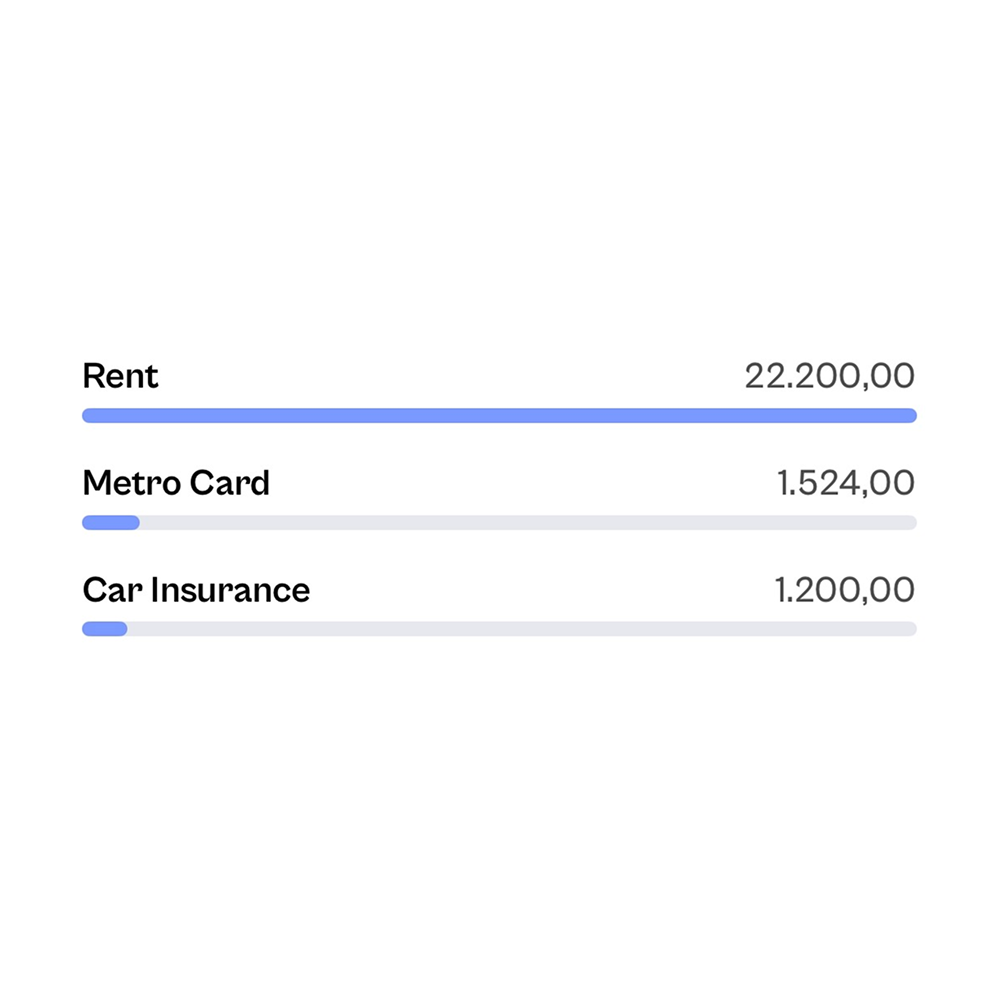

See where your money goes. Find your biggest spending at a glance.

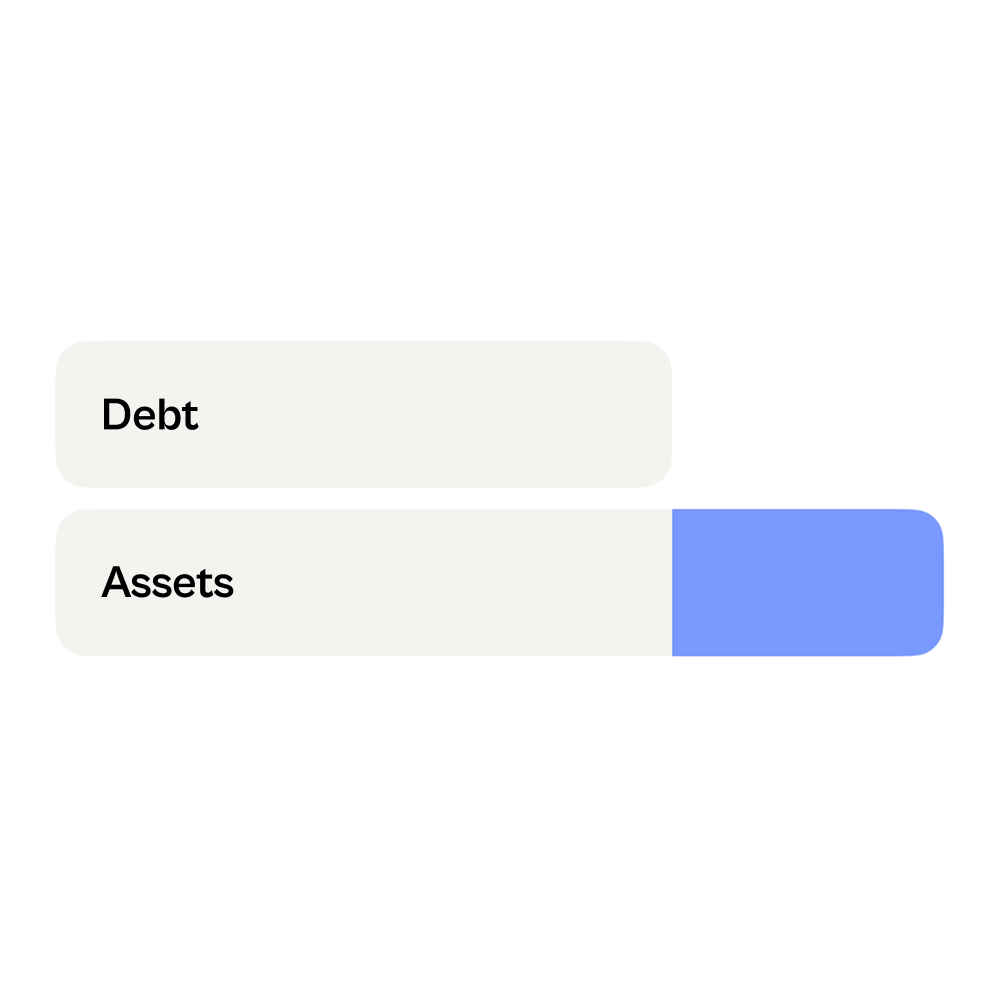

Keep the big picture simple. See assets vs debt over time.

Share it when you need to. Export a clean Excel file.